1. WORLD OLIVE OIL MARKET – 2014/15

Imports of olive oil by a number of countries under customs heading 15.09 and of olive pomace oil under customs heading 15.10 in the first nine months of the 2014/15 crop year (October 2014–June 2015) are reported in the table below.

The data reveal year-on-year import increases of +12 pc in Japan with strong growth from March 2015. US imports remain stable after seeing decreases in March and April followed by increases in May and June. Imports by China likewise hold steady. On the contrary, imports have being going constantly downwards in Australia (−16 pc as of November 2014), Canada (−12 pc) and Brazil (-4 pc), which recorded sharp decreases in May and June. Lastly, through the eight-month period from October 2015 to May 2015, imports were lower in Russia (−26 pc), prompted by a switch of trend in December 2014.

The June 2015 data were not available for the EU at the time of publication but the figures for the first eight months of 2014/15 show an increase of 6 pc in intra-EU acquisitions and 253 pc in extra-EU imports compared with the same period a season earlier. Owing to the heavy drop in output in Spain and Italy, extra-EU imports by both countries soared, particularly imports from Tunisia (+1270 pc and +326 pc, respectively) compared with a season earlier. As reported in the previous issue of this newsletter, this upward movement began in December 2014 even before the change in the EU regulation on the tariff quota at zero-rate duty, a fact connected with the large climb in Tunisian production in the current 2014/15 crop year.

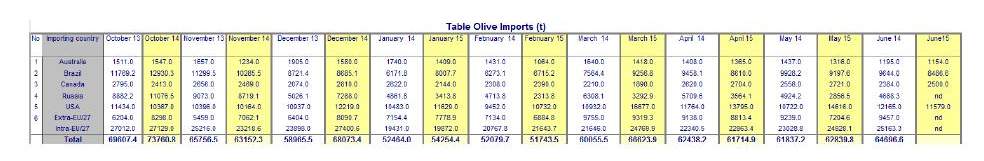

2. WORLD TABLE OLIVE MARKET – 2014/15

In the first nine months of the 2014/15 crop year, i.e. from October 2014 to June 2015, table olive imports (see next table) were higher in the United States (+14 pc) and Brazil (+2 pc) than in the same period a year earlier. In the case of Australia, imports have moved in the opposite direction, dropping by 13 pc since November 2014.

The same applies to Canada (−1 pc). Data for Russia are only available for the eight months from October 2014 to May 2015 and show a constant drop in imports (−14 pc since December 2014).

At the time of publication, the data for June 2015 were not available for the EU but in the first eight months of the 2014/15 season, both intra-EU acquisitions and extra-EU imports went up by 5 pc versus the same period of 2013/14.

II. PRODUCER PRICES

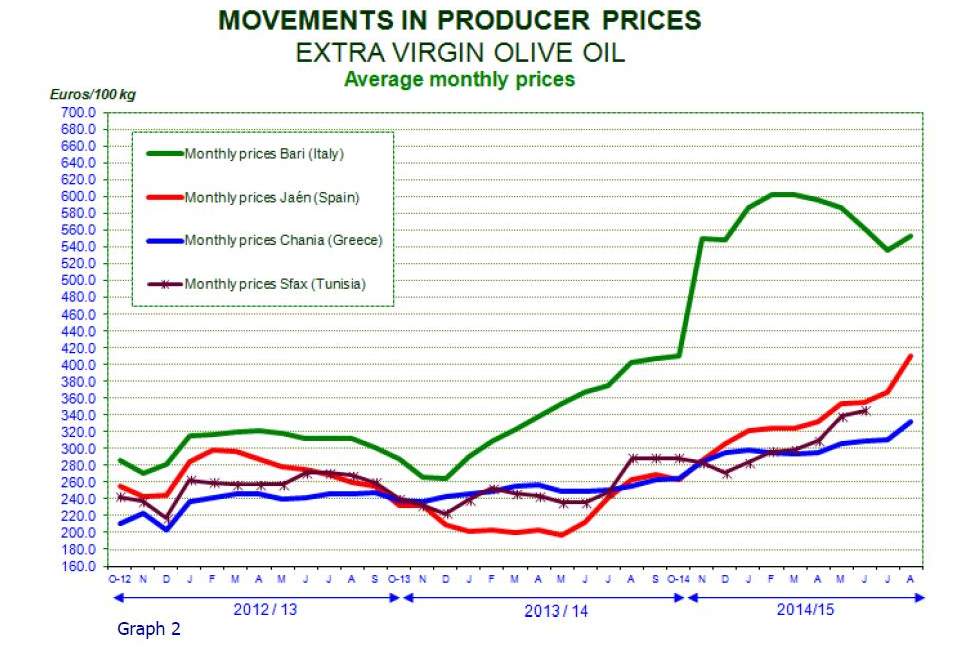

Graph 1 tracks the weekly movements in the prices paid to producers for extra virgin olive oil in the three top EU producing countries plus Tunisia while Graph 3 shows the weekly changes in the producer prices for refined olive oil in the main three EU producers. The monthly price movements for the same two grades of oil are tracked in Graphs 2 and 4.

It is not for the IOC to judge whether these price levels reflect an adequate balance between production costs along the supply chain and the prices that consumers are prepared to pay in their domestic currency to continue consuming olive oil. Nevertheless, this is a concern that all the players on the market will no doubt take into account with an eye to the long-term sustainable equilibrium and development of the sector.

Extra virgin olive oil

Producer prices in Spain have risen steadily since the second half of 2014. After topping €4/kg in the second week of August 2015, they continued upwards to reach a period high (€4.23/kg) in the third week, then dipping to €4.19/kg in the last week. This latest price level is 58 pc higher than a year earlier and 114 pc above the low recorded in the third week of May 2014 (€1.96/kg).

Italy: In recent months, producer prices in Italy have been on a very clear upward trend. In the week from 10 to 16 November 2014, they hit the highest level of both the period under review and the last decade, reaching €6.79/kg. After decreasing slightly in the second last week of December 2014 prices switched back upwards. After some small dips, they were lying at €5.53/kg at the end of August 2015, i.e. 37 pc higher than a year earlier and 109 pc more than the low recorded in the second week of December 2013 (€2.64/kg). Graph 2 shows how the monthly prices of extra virgin olive oil have behaved in recent crop years.

Greece: Prices have been high in recent months, crossing the three-euro/kg barrier in the third week of January 2015. In the last few weeks they have risen to period highs and were lying at €3.54/kg by the end of August, +36 pc higher than the same period a season earlier.

Tunisia: Towards the end of December 2014, producers were being paid €2.73/kg for their extra virgin olive oil. Prices held steady for a while but then started to move upwards in the first week of January 2015. After some small fluctuations, they again reached period highs and were lying at €4.13/kg by the end of August 2015, equating with period-on-period growth of +43 pc.

Refined olive oil

Producer prices for refined olive oil have hit their highest levels for the period under review. In Spain they were standing at €3.75/kg at the end of August 2015, up by 45 pc on the same period of the preceding crop year.

In Italy prices stood at €3.93/kg at the end of August 2015, translating into a period-on-period increase of 60 pc. No price data are available for this product category in Greece.

At the end of August 2015, the price of refined olive oil (€3.75/kg) and extra virgin olive oil (€4.19/kg ) differed by €0.44/kg in Spain. In Italy, the difference in price between the two categories was considerably wider (€1.60/kg – Graph 3).

Photo by Olio Officina

To comment you have to register

If you're already registered you can click here to access your account

or click here to create a new account

Comment this news