New customs nomenclature

Proposal for the harmonisation of the customs system as regards the virgin olive oil group (1509 and 1510). International Olive Council is proposing that the WCO consider the possibility of aligning the customs headings with the definitions established in the IOC standard for olive oils and olive-pomace oils, providing a definition for each heading, with a view to improving market transparency, preventing fraud and, ultimately, protecting product quality and consumers

The IOC Executive Secretariat has submitted a proposal to the World Customs Organization (WCO) for the reform of the international customs system as regards headings 15.09 and 15.10. The 52nd meeting of the Harmonised System Review Subcommittee was held on 1 June 2017 at the headquarters of the WCO (Brussels, Belgium) and was attended by IOC staff members to propose the aforementioned reform. The IOC is the only international organisation that specialises in olive oil and table olives. Its objectives under the International Agreement on Olive Oil and Table Olives, 2015, include the standardisation of the international trade of olive products. Accordingly, the IOC is responsible for facilitating the study and implementation of measures for the harmonisation of national legislations, particularly as regards the trade of olive oil and table olives, and for fostering international cooperation to prevent and, where necessary, combat fraudulent practices in the international trade of all edible olive products. This why the IOC is proposing that the WCO consider the possibility of aligning the customs headings with the definitions established in the IOC standard for olive oils and olive-pomace oils, providing a definition for each heading, with a view to improving market transparency, preventing fraud and, ultimately, protecting product quality and consumers.

Currently, the classification of the international Harmonised System is not aligned with the IOC’s definitions. While the Harmonised System only refers to virgin olive oil (virgin olive oil 15.09.10), the IOC has requested that a distinction be made between three nomenclatures (extra virgin olive oils, virgin olive oil and lampante virgin olive oil). For the 151000 olive-pomace oil group, the IOC requests that a distinction be made between two nomenclatures (crude olive-pomace oils and olive pomace oils).

The Directorate General for Taxation and Customs of the European Union (DG-TAXUD), on the proposal of the Directorate General of Agriculture and Rural Development of the European Commission, has drawn up a new customs nomenclature, published in January 2017 for the virgin olive oil group (150910), providing a level of detail that differentiates between the different types of oils. The 15091010 category, which already existed, refers to lampante virgin olive oils and two new categories have been created: 15091020 for extra virgin olive oil and 15091080 for virgin olive oil. This new differentiation, as well as bringing transparency to the market, enables a more precise analysis of the trends in the different categories of oil. In this regard, the Directorate-General for Agriculture and Rural Development, together with TAXUD, continue working to differentiate between containers (bottled or bulk) for the three most-consumed categories of olive oil, extra virgin olive oil, virgin olive oil and olive oil.

The Foreign Agricultural Service of the United States Department of Agriculture, has been developing a new customs nomenclature for the virgin olive oil group (150910) that differentiates between four types of olive oil (organic extra virgin olive oil; extra virgin olive oil; organic virgin olive oil and virgin olive oil). In respect of these four categories, a differentiation is also made between 18kg containers.

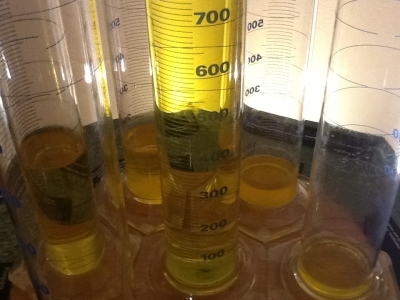

Photo by Luigi Caricato

To comment you have to register

If you're already registered you can click here to access your account

or click here to create a new account

Comment this news